Reduce Costs. Remove Uncertainty. Deliver Effectively.

Strategic, Enterprise & Program Risk Management

SaaS and On-Premise solutions to empower risk identification, improve risk communication and create a risk aware culture.

Benefits of IRIS Risk Management Software

IRIS Intelligence Risk Management software helps you to deliver company strategy more effectively. Our tool improves risk communication, increases visibility of both risks and mitigations and improves decision making through automated reports and return on investment calculations.

Best Practice Management Practices

Best Practice Risk Management Processes Swiftly embed from ISO 31000, the PMBoK, ISO 27001 or government risk guidance.

Risk Identification Support

Checklists and Brainstorming prompts as recommended by the International Risk Governance Council available at your fingertips.

Adaptable Risk Assessment Criteria

Criteria are flexible enough to adapt to any environment but ensure consistency of assessment within each register.

Quantitative Statistical Analysis of Risk Exposure

Quantify your risk exposure using robust statistical techniques rather than simple estimation procedures (for those that need it).

Return on Investment Calculations

Instantly prioritize activity based on the most “bang for your buck”. Ensure the maximum benefits are generated from limited budgets.

Generate Timeline Views for Mitigation Plans

The plan can be instantly viewed in a Gnatt chart and progress against this plan monitored to prevent slippage.

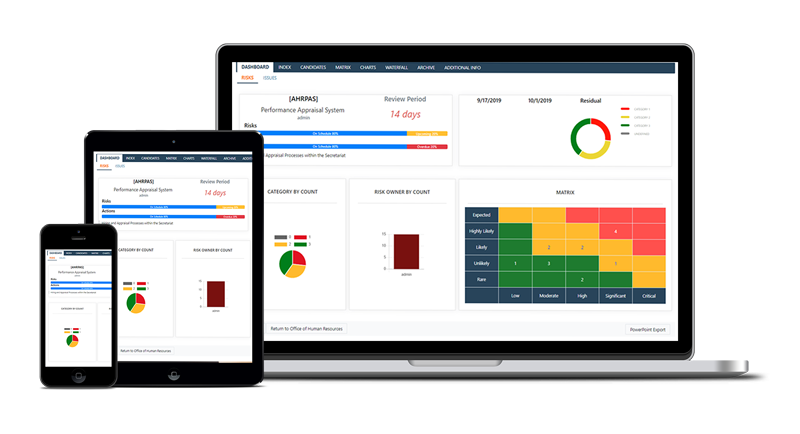

Intuitive and Easy to Use Interface

Most users are up and running with no formal training. The individual user profiles mean IRIS can target the level of complexity to a specific user profile.

Automated Email Reminders and Red Flags

Keep data fresh with automated email reminders to risk owners when actions are due and highlight any slippage to project managers early.

Secure Audit Trail

No more worries about change control on Excel spreadsheets. No more trouble retaining historic data. Our secure audit trail provides a full history for internal and external audit assurance.

Dynamic Risk Matrices

Provide an instant snapshot of the most important items and any change status.

Waterfall/Risk Burndown Charts

Instantly and simply demonstrate the trend in the progress of the risk over time and compare the impact of risk mitigations with the original plan.

Integration with Excel, PowerPoint, Project and Other Systems

Upload your legacy risk data in a few minutes. Generate PowerPoint reports for Senior Management in seconds. Export latest data to Excel for wider analysis whenever you like.

Fully Web Enabled Risk Management Software

Ability to share risk management data across teams ranging from a few individuals to many thousands across several continents.

License Individual Users or Share Licenses Across a Team

Both named users and concurrent license models are available to help you obtain the most cost effective risk management solution.

Host the System in House or Use an IRIS Hosted Server

Flexible arrangements mean the IRIS software can match the preferences of your organization.

Create Your Own Report Templates

Need a few report formats? No problem – just change the slide master, upload, and your new template is waiting for you.

Restrict Access to Sensitive Items

Specific access restrictions can be set up for each user so they can only view or amend risks for their own project or department.

Add New Custom Data Fields

If your requirements change or expand, IRIS allows you to edit and add new data fields whenever you need to. Our tool will grow alongside you as your needs evolve.

Industries

"IRIS helped us to derive major financial & performance improvements. The combination of quantitative and qualitative functionality provides robust decision support and the ability to navigate through complex scenarios."

MEHENDER RAWAT, PROGRAM MANAGER, LONDON UNDERGROUND

Latest Updates

NEWS

CCS extends IRIS G-Cloud listing until 2024

IRIS Intelligence is excited to share the news that the Crown Commercial Service (CCS) has granted an extension to IRIS

Blog

8 steps to start implementing TCFD Recommendations

Climate change is one of the most pressing issues of our day. The effects are already being felt in several parts of the world and

Events

IRIS participates in Sustainable Infrastructure Trade Mission 2023

IRIS is pleased to have been asked to participate in the Sustainable Infrastructure Trade Mission 2023, organized by the UK

See What IRIS Intelligence Can Do for Your Business

IRIS embeds best practice risk management techniques in a fully automated system that can be instantly customized to match specific customer preferences and reporting requirements.